- About

- About

-

-

About - ARDAK's legacy and SIGNIFICANT differentiator, ARDAK's Contract Exploitation System (ACES) Competitive Intelligence Tool Comprises of Modules that can be licensed to meet your unique needs

-

-

- Partners and Affiliations

-

-

Partners & Affiliations - ARDAK has been an active member in the GovCon / Aerospace and Defense (A&D) Industry for 35 + years

-

-

- About

- Wrap Rates

- Rate Derivation (RD) Methodology

-

-

RD Indirect Rate Methodology - ARDAK’s Wrap Rate Methodology was used to develop the most sophisticated Wrap Rate Intellectual Property (IP) in the industry. While emulated by our competitors ONLY ARDAK has 35 + years of continuous Wrap Rate IP enhancements, and every analyst has a minimum of 20 years’ experience using ARDAK's Contract Exploitation System (ACES)

-

-

- RD Summary

-

-

RD Summary - A TOP DOWN estimates of the Wrap Rate Derivation (multiple of Fringe, Overhead, and G&A, without regard to Fee or Material Handling costs) are maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- RD HIGH Level Decomposition

-

-

RD HIGH Level Decomposition - A TOP DOWN HIGH Level Wrap Rate Decomposition consisting of the estimated Fringe, Overhead and G&A for both plant and site operations are maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- RD LOW Level Decomposition

-

-

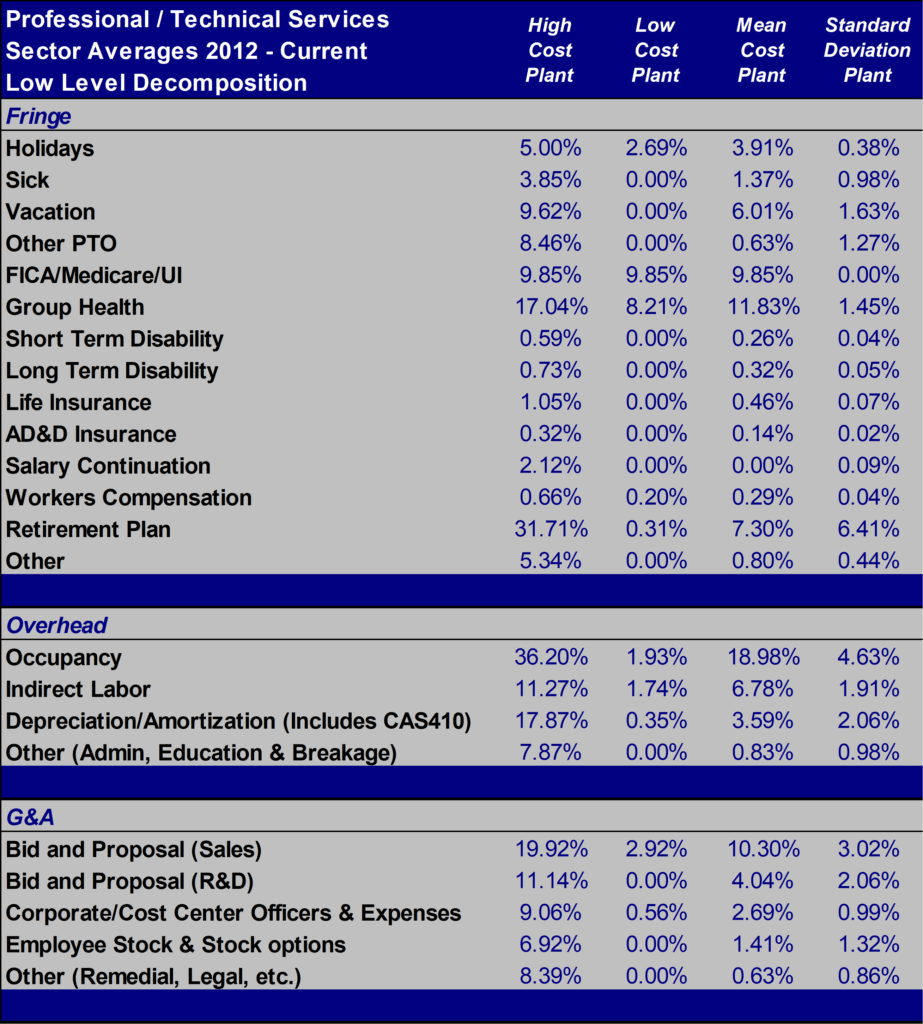

RD LOW Level Decomposition - A BOTTOM Up LOW Level Wrap Rate Decomposition consisting of 23 DESCRETE ELEMENTS of Fringe, Overhead and G&A and Relative Competitiveness (High, Low, Mean, Standard Deviation) to the Market Sector at the element level are maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- RD LOW Level ELEMENT Descriptions

-

-

RD LOW Level ELEMENT Descriptions - 23 DISCRETE ELEMENTS of Fringe, Overhead, and G&A are defined and normalized within ARDAK's Contract Exploitation System (ACES)

-

-

- RD Price To Win (PTW) Trending

-

-

RD Price To Win Trending - Proprietary PTW algorithms are applied to 23 DISCRETE ELEMENTS of Fringe, Overhead, and G&A for each procurement class developed (Priority, Must Win, and Strategic) PWIN Rates are maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- RD PREDICTIVE Rate Derivations

-

-

RD PREDICTIVE Summary - Several Wrap Rate Predictive Models including UNPOPULATED JV’s, Notional, Pro Forma, and other custom modifications to a competitor's cost basis are maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- RD Competitor Target Acquisition

-

-

RD Competitor Target Acquisition - Utilizing ARDAK's Contract Exploitation System (ACES) Target Acquisition Functionality, ARDAK will validate or suggest the Competitor Cost Center target that has the lowest Wrap Rate, domain expertise, and Customer past performance deemed to be the most Significant Competitive Threat

-

-

- RD's and ARDAK's Contract Exploitation System (ACES)

-

-

RD's and ARDAK's Contract Exploitation System (ACES) - Widely Recognized as the GOLD STANDARD, and the “Standard & Poor’s” of Indirect / Wrap Rate Analysis with in the A&D Industry

-

-

- Market Based Affordability (MBA)

-

-

Market Based Affordability (MBA) - Since the 2008 Financial Crisis, ARDAK's Contract Exploitation System (ACES) was utilized for dozens of MBA Analyses relative to specific Market Sectors for the largest A&D Contractors in the world

-

-

- Rate Derivation (RD) Methodology

- PTW

- Service Centric PTW

-

-

Service Centric PTW - Service Centric PTW Opportunities are those that involve very little or no material, custom solution, or platform development, and are predominately labor based and utilizes ARDAK's RATE TO WIN (RTW) Models

-

-

- Platform / Solution Centric PTW

-

-

Platform / Solution Centric - Platform / Solution Centric PTW opportunities are those that involve a customized solution such as a weapon system and typically leverages one or more of ARDAK’s Proprietary Cost Models

-

-

- EMMARS PTW Use Case

-

-

EMMARS PTW Use Case - See an example of a Platform / Solution based PTW utilizing ARDAK's Proprietary Cost Models

-

-

- Service Centric PTW

- Strategic Advisory

- Portfolio Analysis

-

-

Portfolio Analysis - Validate, Optimize, Expand, Realign, and Develop a Go To Market Strategy utilizing ARDAK's Contract Exploitation System (ACES)

-

-

- Market Analysis

-

-

Market Analysis - Staying on top of changing markets requires Competitive Intelligence. By utilizing ARDAK's Contract Exploitation System (ACES) Market Analysis is your basis for making sound decisions about where to utilize your resources now and in the future

-

-

- Market Based Affordability (MBA)

-

-

Market Based Affordability (MBA) - Since the 2008 Financial Crisis, ARDAK's Contract Exploitation System (ACES) was utilized for dozens of MBA Analyses relative to specific Market Sectors for the largest A&D Contractors in the world

-

-

- Mergers & Acquisitions (M&A’s)

-

-

Mergers & Acquisitions (M&A's) - ARDAK has supported $Billions of M&A's including candidate Identification, Review, Screening, Market Participation, Customer Base, and Programs utilizing ARDAK's Contract Exploitation System (ACES)

-

-

- Portfolio Analysis

- Competitive Intel

- Competitor Assessment

-

-

Competitive Assessments – A deep utilizing ARDAK's Contract Exploitation System (ACES) delivering Competitive Posture, Recent Wins & Losses, Operating Segments, Financial Performance, M&A's, Reliance on Government & Commercial Business, Leading Customers, Products & Services, Contracts, and Contract Types

-

-

- Agency Analysis

-

-

Agency Analysis – A deep utilizing ARDAK's Contract Exploitation System (ACES) providing significant visibility into Agency's Leading Competitors, Products & Services, Contracts, and Contract Types

-

-

- Rate Derivation (RD) RD Summary

-

-

RD Summary - A TOP DOWN estimates of the Wrap Rate Derivation (multiple of Fringe, Overhead, and G&A, without regard to Fee or Material Handling costs) are maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- Direct Labor (DL) Rate Analysis

-

-

Direct Labor (DL) Rate Category and Analysis – Thousands of LCATs by Title, Description, Years of Experience, Educational, Clearance Requirements, and Geographic Location are stored and maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- Material Handling (MH) Analysis

-

-

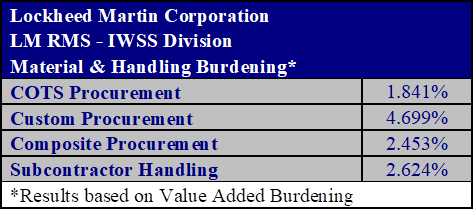

Material Handling (MH) Analysis –An assessment of the competitor’s Material & Handling by burdening policy (Value Added, Fixed Costs, Direct Material, Other Material, etc.) and estimated burden rate are stored and maintained within ARDAK's Contract Exploitation System (ACES)

-

-

- Fee Analysis

-

-

Fee Analysis – Scrubbed contract actions stored in ARDAK's Contract Exploitation System (ACES) are analyzed to estimate a competitor’s Fee structure. The operating margin is calculated and a comparative analysis is then performed to validate the Fee which is then stored in ACES

-

-

- A&D Cost Models

-

-

A&D Cost Models - ARDAK maintains dozens of proprietary cost models relative to specific sectors such Fixed Wing, Rotary Win, Limited Initial Rate Production (LRIP), Full Rate Production (FPR), and Full Life Cycle Costs

-

-

- Competitor Assessment

- Past Performance

- Government Agencies ($100B+ PTW WINS)

-

-

Government Agencies – Price To Win (PTW) Past Performance by Government Agency ALL utilized ARDAK's Contract Exploitation System (ACES)

-

-

- Use Cases

-

-

Use Cases - Price To Win (PTW) Past Performance by Use Case ALL utilized ARDAK's Contract Exploitation System (ACES)

-

-

- Government Agencies ($100B+ PTW WINS)

- News & Insights

- Contact Us